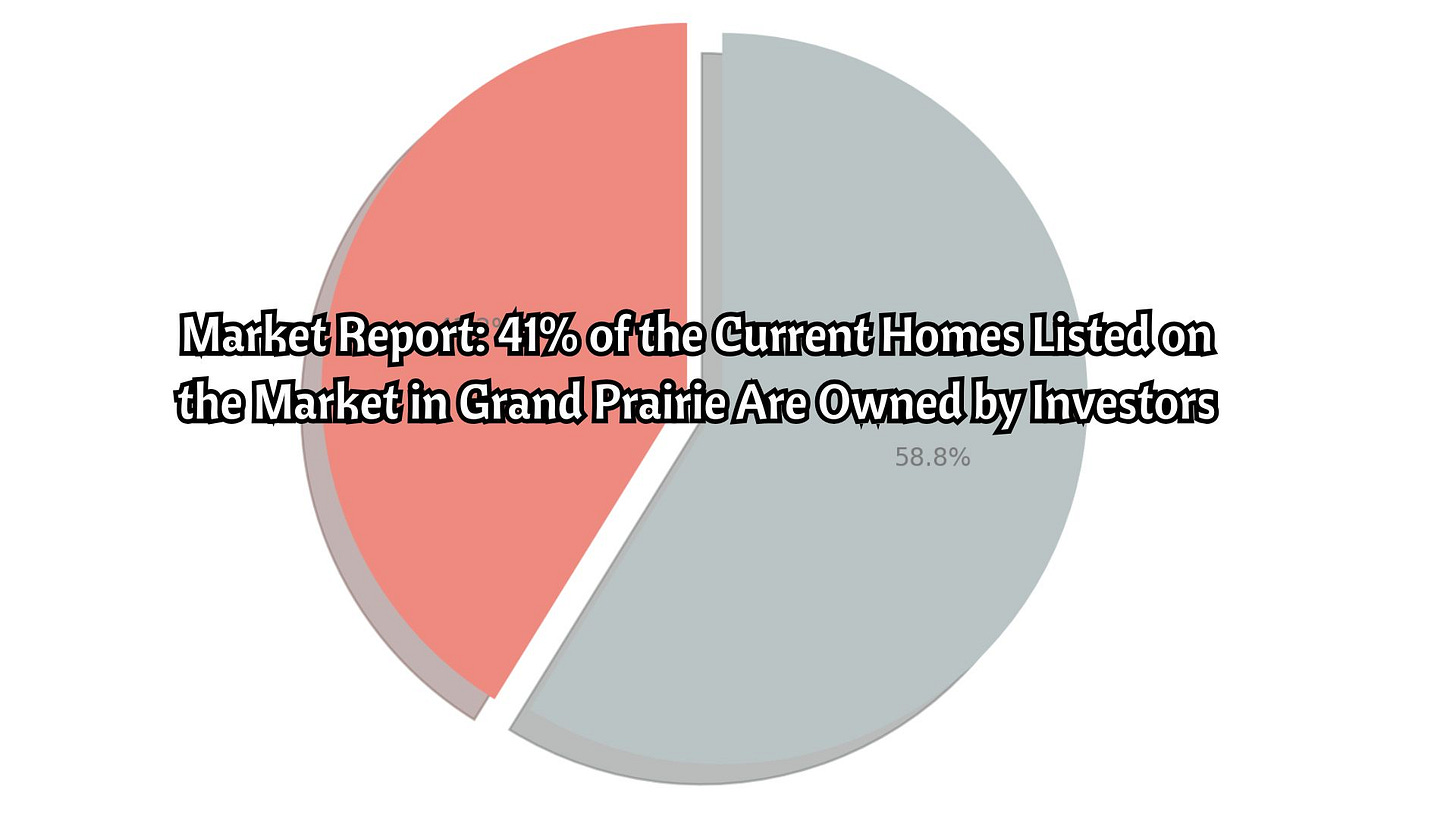

41% of the Current Homes Listed on the Market in Grand Prairie Are Owned by Investors

How investor ownership is reshaping Grand Prairie’s housing market — and what it means for sellers, buyers, and the future of our community.

This article is brought to you by Jenna Pecor with Bancroft Realty. Jenna is a Grand Prairie-based agent and a Seniors Real Estate Specialist (SRES®) who has been helping Grand Prairie families buy and sell homes since 2014.

When people talk about housing affordability, the conversation usually circles around one thing: inventory. How many homes are available? Is there enough supply? But in Grand Prairie, the real story is deeper. It’s not just about the number of homes — it’s about who owns them and who is selling them.

According to Realtor, about 16% of current listings nationwide are owned by investors. In Grand Prairie, that number is more than double — 41%, or 147 out of 357 active listings. (And I know, because I manually looked through each listing’s tax roll and counted them myself.)

Of those 147 investor-owned listings, 32 are new builds. But here’s the catch — these weren’t simply listed by builders. Many builders, facing slower sales and high prices, have turned to investors to move inventory. That means brand-new homes, which should have been opportunities for families, are already in investor hands before they ever had a fair chance on the open market. The remaining 115 homes are resales — properties that investors previously bought and now are putting back up for sale.

And it matters what kind of investors we’re talking about. Roughly a quarter of investor-owned homes here belong to local “mom-and-pop” landlords, but the majority are controlled by LLCs and corporations, many of them based outside our community. These aren’t neighbors building wealth with one rental property. They’re companies treating houses like numbers in a portfolio.

This is where affordability and equity collide. People often talk about making

housing more equitable, but for many years now, the market has not been equitable for families. When humans — who buy homes to live in them, raise kids, and build community — are forced to compete against cash flow spreadsheets, investment portfolios, and profits from flips, the playing field is tilted. Families budget based on income; corporations calculate based on margins. The result is higher prices, fewer opportunities, and entire neighborhoods where ownership shifts away from people who live here.

Government intervention should always be a last resort when it comes to the housing market. A healthy open market is usually the best solution. But right now, nothing stops corporations from buying up entire blocks of single-family homes. That doesn’t just affect prices — it reshapes the character of neighborhoods. Owner-occupied homes bring stability and connection, while absentee-owned rentals bring turnover and distance.

From a city budget standpoint, there are some short-term benefits to investor ownership. Investors don’t qualify for property tax exemptions like the homestead exemption, and because they’ve usually owned the home for less time, they often pay the highest taxes. A family who has lived in a home for 10 years may pay on a much lower assessed value than a property that just sold last month. But if property tax revenue is the only metric a city looks at, it misses the bigger picture.

Owner-occupants contribute more than taxes. They strengthen schools, support civic groups, shop local, and anchor the social fabric of a community. They also step up where government can’t or won’t — meeting needs of less fortunate neighbors through churches, nonprofits, and everyday acts of generosity. That kind of community-driven support reduces the need for government subsidies and stretches the city’s resources further.

And not all property owners are alike. Small business owners who live here, work here, and sometimes run their businesses out of their homes invest far more in Grand Prairie than absentee investor groups ever will. Apartment complexes at least have a public presence and accountability. Single-family homes owned by LLCs outside the city limits don’t — and rarely feel any responsibility to the community beyond collecting rent.

This is why keeping homes owner-occupied matters so much. When sellers choose to sell on the open market, even after realtor commissions, most will net more than they would from a quick investor sale. And even if an investor does end up buying the property, the home should sell for a competitive, market-driven price — not just what’s easiest for the investor’s bottom line. That protects equity for the seller, and it helps keep home values aligned with the real demand from families who want to live here.

So here’s my encouragement: if you’re thinking about selling, talk to a Grand Prairie realtor who understands this market. Ask them to prepare a Net Proceeds Sheet before you make a decision. Compare what you’d walk away with from a traditional sale versus an investor offer. Keeping our community more owner-occupied and less investor-owned isn’t just good for your equity — it’s vital for the integrity and future of Grand Prairie.