The video above is from the August 14 Special Meeting Budget Workshop, found on the district’s website, along with the video from the regular meeting later that same day. The video was run through the transcript generator in Substack, which you as the reader now have access to.

This reporting is part of our GPISD channel, in which we discuss all things GPISD. To support this channel, subscribe for free below or reach out to facesofgrandprairie@gmail.com if you’re interested in being a financial sponsor.

Grand Prairie ISD is staring at a projected $21 million budget shortfall for the coming year. One option now on the table: adding 3.17 “disaster pennies” to the tax rate, thanks to a state provision triggered when Dallas County was under a disaster declaration in 2024.

On paper, it sounds simple enough. The district frames it as “just $12–$15 a year on a $300,000 home.” Superintendent Dr. Gabe Trujillo was careful to emphasize this isn’t a solution — just a strategy worth considering as trustees work through the budget crisis. But as with most things in Texas school finance, the reality is more complicated.

Texas law allows districts in disaster-declared counties to add up to 3.17 cents to their Maintenance & Operations (M&O) rate for one year without voter approval. For GPISD, that would generate about $5.14 million in new revenue. (For reference, this declaration was issued after high winds and hail in Dallas County in May 2024 — see City of Dallas emergency report.) The complication is that GPISD itself sustained little direct damage from those storms, which is why some trustees question whether it’s ethical to lean on this provision as a financial strategy. (Video below is a clip of Trustee Emily Liles’ concern of ethics).

Other districts (Cy-Fair, Judson, Fort Bend) have used disaster pennies too, often to fund raises or cover shortfalls — but all still faced big deficits the following year. One trustee argued that indirect costs like skyrocketing insurance premiums still count as “disaster-related” expenses. But the optics of using a loophole when GPISD itself had little direct damage remain hard to ignore.

The district’s “$12–$15” talking point is based on a statewide average $300K home. But in Grand Prairie, actual homeowners will pay a bit more. We pulled 2025 ISD taxable values randomly from real homes across all trustee districts. Here’s what the 3.17 disaster pennies (remember: it’s a percentage, not actual “pennies”) would actually add to their annual tax bill:

Trustee District 2025 ISD Taxable Value Added Tax from Disaster Pennies

District 1 $198,510 $62.93

District 2 $241,460 $76.54

District 3 (At-Large) $377,913 $119.80

District 4 $41,810 $13.25

District 5 $77,316 $24.51

District 6 $331,990 $105.24

District 7 (At-Large) $377,913 $119.80

Average across the city: $74.58 per home, on average.

Dr. Trujillo stressed to trustees that disaster pennies are only a strategy to consider:

“This was a strategy to look at — just entertain some information about this and see what and how this can benefit the process. All I’m asking is for us to be open to the full discussion of it, and then you have time to make a decision… it’s five million dollars, and then we are going to look at seventeen million dollars to figure out what’s the next phase as we move forward.”

In other words: disaster pennies are not the fix — they are one tool, and the board must decide if it’s worth using. Even if disaster pennies pass they cover just one quarter of the shortfall. That leaves GPISD scrambling for another $16–$17 million.

Disaster pennies aren’t free money — they’re a temporary tax increase that shifts more burden onto homeowners without fixing systemic problems. Yes, they could buy GPISD some time, and in normal circumstances my instinct is that few taxpayers would make much fuss if it meant helping the district. But this district — and this board specifically — has not been without trust issues in the public eye, especially over the past 12 months.

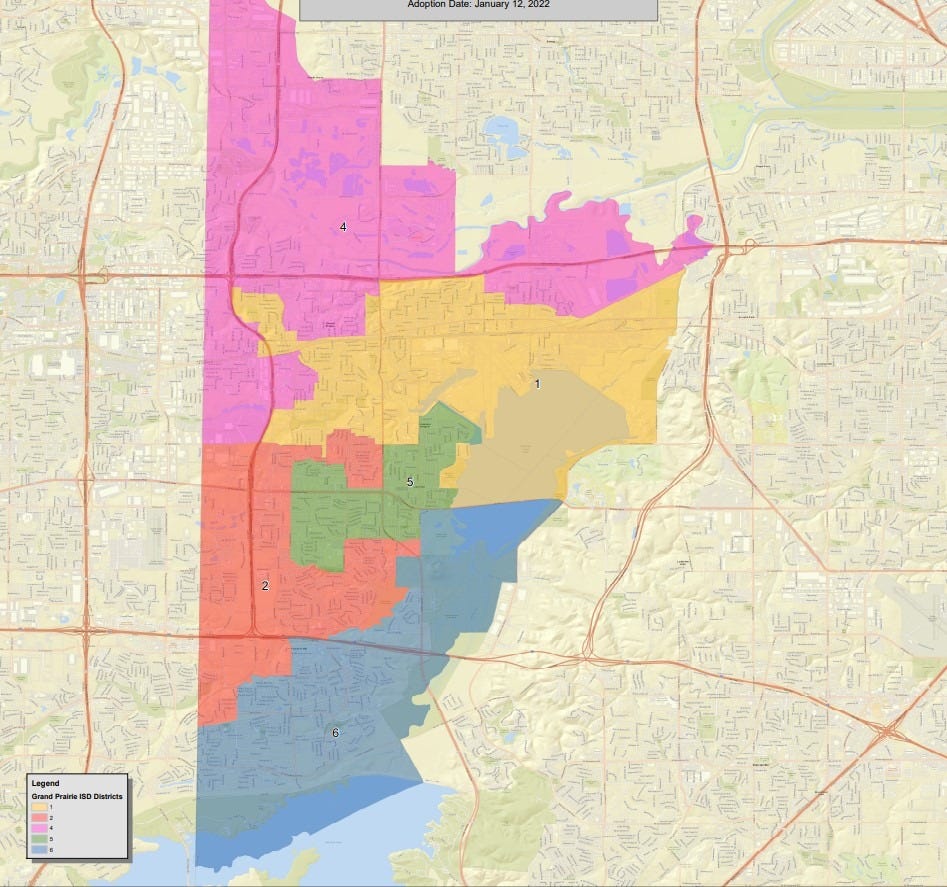

In my research, Trustee Emily Liles has proven to be the the only consistent public voice of accountability on the board of trustees, willing to stick her neck out despite pushback from colleagues, none of whom have shown much interest in making public communication or transparency a priority in their public relations leadership strategies. You can find her regular recap of meetings here. To reach out to your Board Trustee Representative about this vote or any issue, you can visit https://www.gpisd.org/board to find their contact information. Grand Prairie district boundaries can be found below.

The Disaster Pennies vote will be on the agenda for a vote on August 28.

In Part Two scheduled to be released tomorrow, we’ll look at what’s missing from every strategy to increase enrollment: GPISD Board Trustee behavior. Notably absent from the August 14 meeting was District 4 Trustee David Espinosa, who has now made skipping meetings a consistent habit. He was even slated to be discussed on a closed-session agenda item (“10.A.2 — the evaluation, duties, and discipline of a public officer,”) widely assumed to be tied to his recent antagonistic and unprofessional posts on his official District Facebook page), but chose not to attend.